who pays sales tax when selling a car privately in illinois

When you sell your car you must declare the actual selling purchase price. Income Tax Liability When Selling Your Used Car.

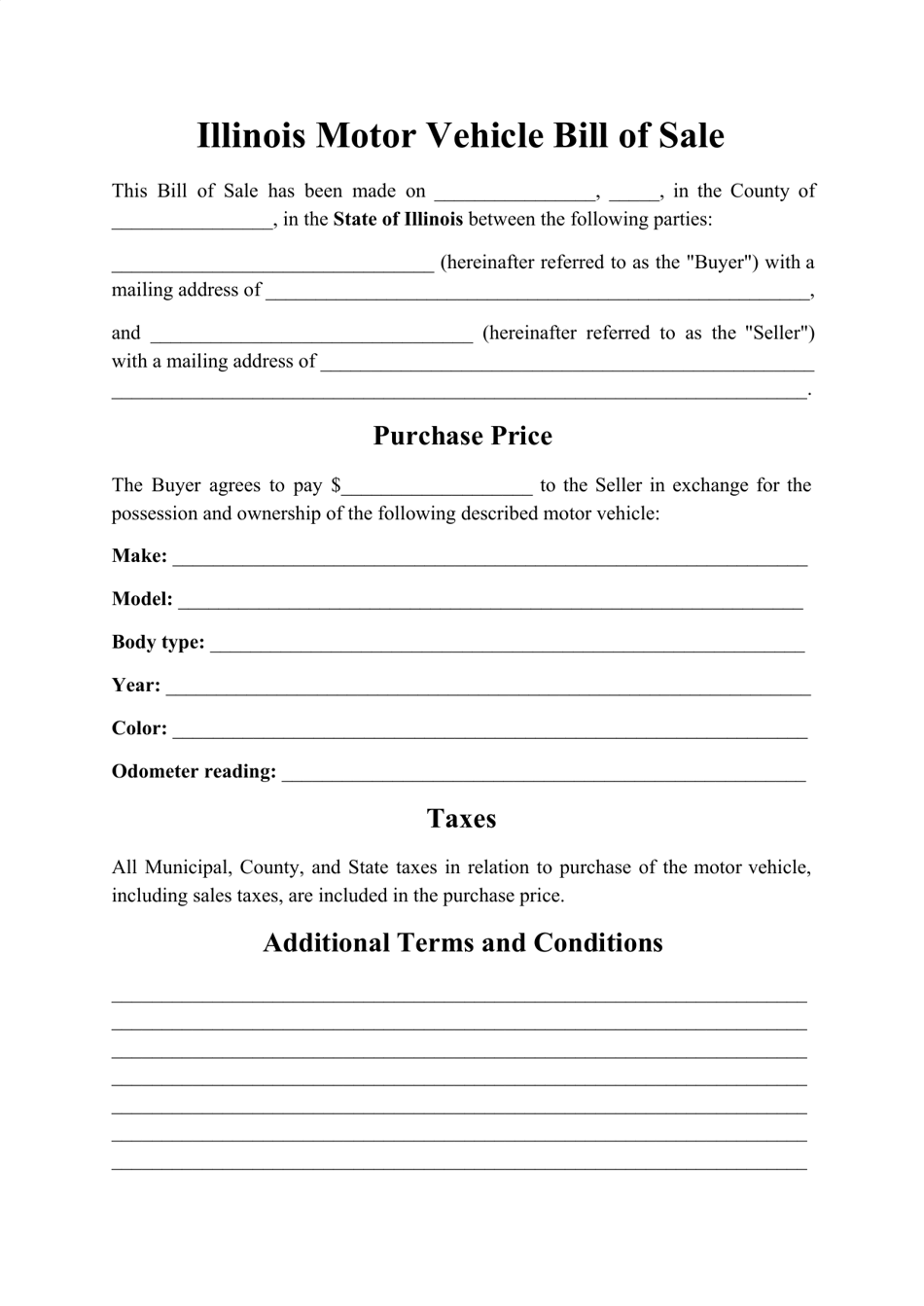

Illinois Motor Vehicle Bill Of Sale Form Download Printable Pdf Templateroller

For vehicles worth less than 15000 the tax is based on the age of the vehicle.

. For vehicles worth less than 15000 the tax is based on the age of the vehicle. If you purchased the car in a private sale you may be taxed on the purchase price or the standard presumptive value SPV of the car whichever is higher. The buyer must pay 95 to the Secretary of State and a tax to the Department of Revenue.

Do not let a buyer tell you that you are supposed to pay the sales tax. It depends on the length of the permit. For vehicles worth less than 15000 the tax is based on the age of the vehicle.

To calculate the sales tax on your vehicle find the total sales tax fee for the city. For vehicles worth less than 15000 the tax is based on the age of the vehicle. The buyer must pay all sale taxes.

The buyer must pay 95 to the Secretary of State and a tax to the Department of Revenue. The buyer pays sales tax on the purchase price of the car. Its added to the initial cost of registration.

Who pays sales tax when selling a car privately in Illinois. Retailers who make sales of services when the goods are transferred in the course of the provision of their services and which are not minimus must declare and pay the service tax on their selling price using Form ST-1 VAT return. A retailer who sells services is of minimus if.

Sales taxes in Illinois are calculated before rebates are applied so the buyer who pays 9500 after a 2500 rebate will still pay sales tax on the full 12000. Illinois collects a 725 state sales tax rate on the purchase of all vehicles. When a person buys a car from someone who is not a car.

Saying a SALE is a GIFT is FRAUD. The buyer will have to pay the sales tax when they get the car registered under their name. The sales tax applies to transfers of title or possession through retail sales by registered dealers or.

Who pays sales tax when selling a car privately in Illinois. For vehicles worth less than 15000 the tax is based on the age of the vehicle. Cost of Buying a Car in Illinois Increased in 2020.

The buyer must pay 95 to the Secretary of State and a tax to the Department of Revenue. If you sell a 2017 Mercedes and claim a sale price of 15000 or less you will have to pay tax on the 15000 or less val-uation. Existing state residents who have purchased an out-of-state vehicle will also be required to pay the 6 percent use tax of the vehicle sale price.

But if the original sales price plus the improvements add up to 8000 and you sell the car for 10000 youll have to pay capital gains tax on your 2000 profit. The seller paid sales tax when they bought the car so they only pay income tax on the capital gain which is higher if they depreciated. Who pays sales tax when selling a car privately in Illinois.

For example a 15000 car will cost you 99375 in state sales tax. On the other hand if you are making any profit out of this car you need to indicate it in your next years tax return as a capital gain. The buyer is responsible for paying the sales tax according to the sales tax rate in the jurisdiction where you sell the vehicle.

For vehicles worth less than 15000 the tax is based on the age of the vehicle. However there WILL be an audit by the Illinois Department. However if you bought it for.

The buyer must pay 95 to the Secretary of State and a tax to the Department of Revenue. To calculate how much sales tax youll owe simply multiple the vehicles price by 006625. Multiply the vehicle price after trade-in andor incentives by the sales tax fee.

Steps To Take When Selling A Car In Illinois - Cash Cars Buyer. Sales taxes in Illinois are calculated before rebates are applied so the buyer who pays 9500 after a 2500 rebate will still pay sales tax on the full 12000. If you spend 7000 on a car and an additional 1000 on improvements but you sell the car for 7000 its considered a capital loss and you dont need to pay tax on the sale.

However you should know that you may have to pay a gift tax depending on how much the car is worth. This tax is paid directly to the Illinois Department of Revenue. Who pays sales tax when selling a car privately in Illinois.

The service use tax due is determined by the senior service employee car dealership. The buyer must pay 95 to the Secretary of State and a tax to the Department of Revenue. As this article indicated if youre not making any profit out of your used vehicle by comparing its original value to the selling value you dont need to pay any tax returns.

The buyer is responsible for paying the sales tax according to the sales tax rate in the jurisdiction where you sell the vehicle. Who pays sales tax when selling a car privately in Illinois. A used car in Texas will cost 90 to 95 for title and license plus 625 sales tax of the purchase price.

However you do not pay that tax to the car dealer or individual selling the car. Buyers must pay a transfer tax when they buy a car from a private seller in Illinois although this tax is lower when you buy from a private party than when you buy from a Dealer. If you spend 7000 on a car and an additional 1000 on improvements but you sell the car for 7000 its considered a capital loss and you dont need to pay tax on the sale.

Car Tax By State Usa Manual Car Sales Tax Calculator

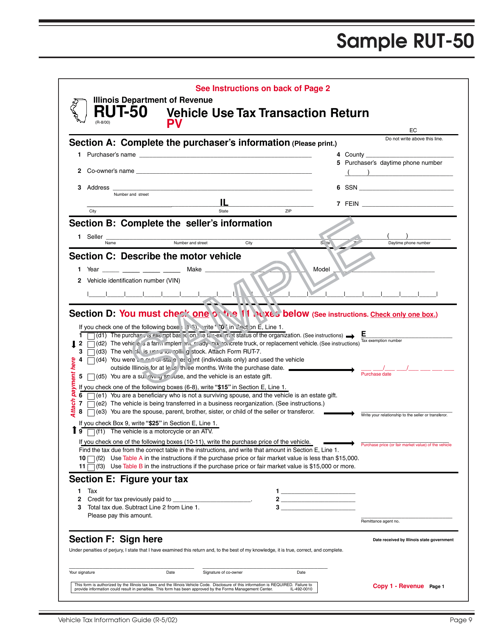

Sample Form Rut 50 Download Printable Pdf Or Fill Online Vehicle Use Tax Transaction Return Illinois Templateroller

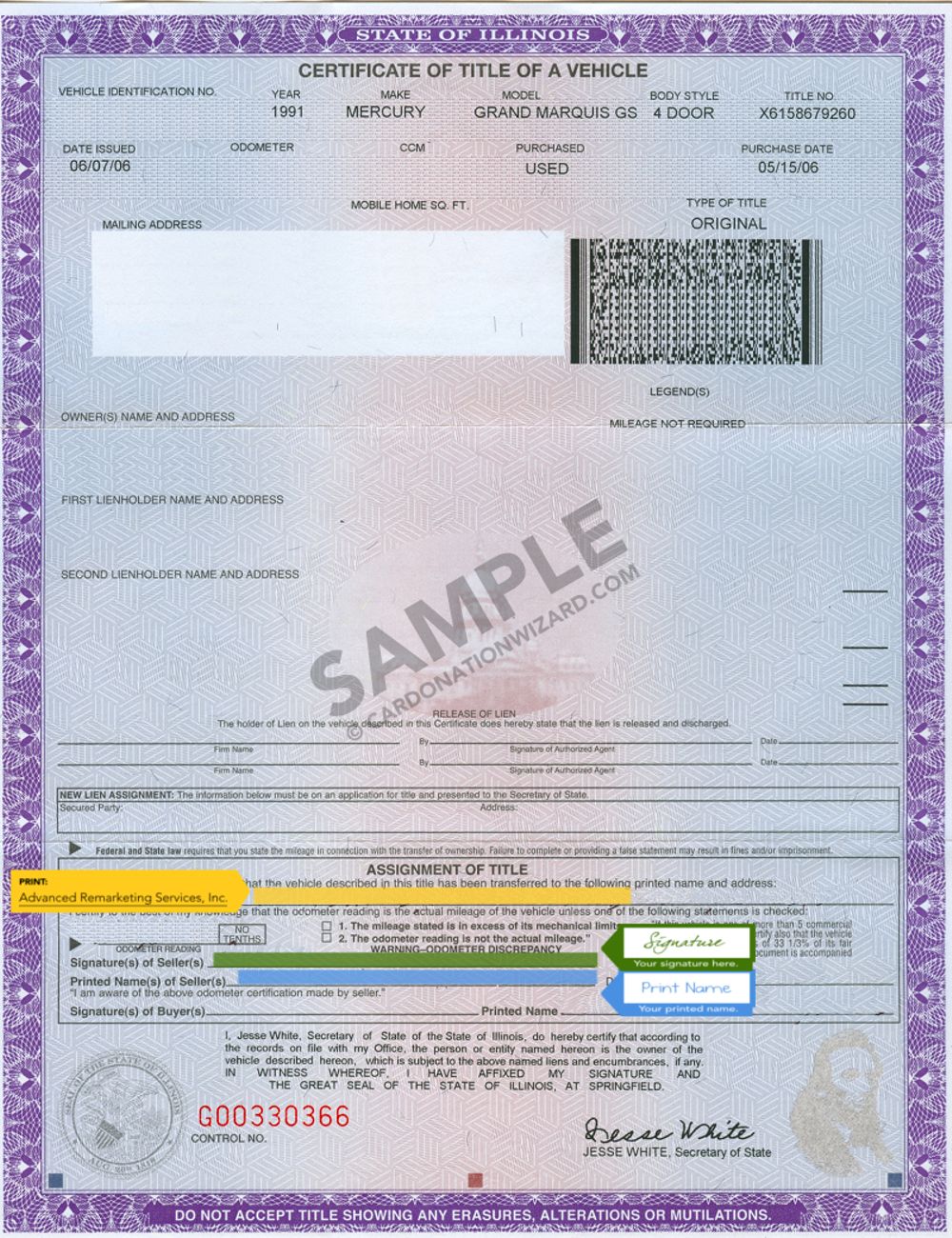

How To Register A Car In Illinois With Pictures Wikihow

Illinois Bill Of Sale Pdf Templates Jotform

What Is The Sales Tax On A Car In Illinois Pasquesi Sheppard Llc

Taxes When Buying A Car Types Of Taxes Payable On A Car Purchase Carbuzz

Buying From A Private Seller Vehicle Registration Titling And Fees Explained

Do I Pay Illinois Taxes When Buying A Car In Illinois Illinois Legal Aid Online

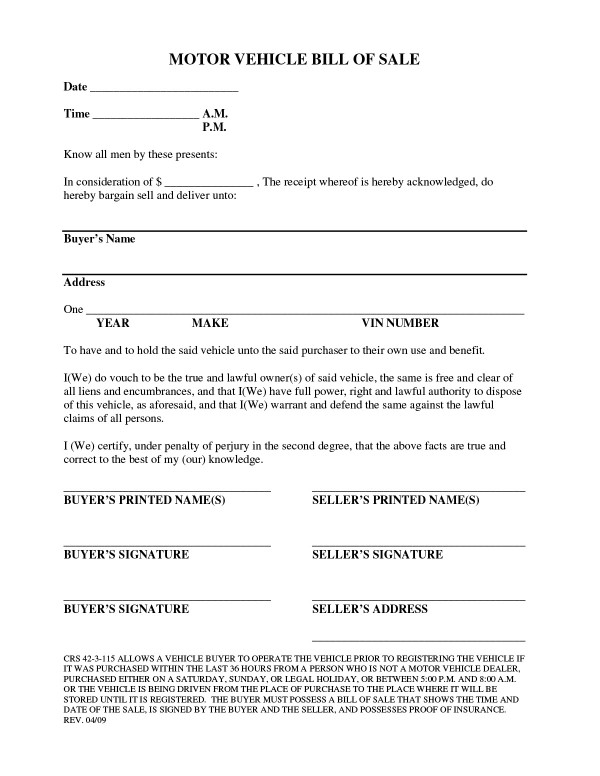

Colorado Bill Of Sale Forms And Registration Requirements 2020

Who Pays Taxes On A Gifted Vehicle Sell My Car In Chicago

Car Bill Of Sale Pdf Printable Template As Is Bill Of Sale

Illinois Sales Tax Credit Cap Important Information

What Is Illinois Car Sales Tax

Illinois Title Transfer Buyer Instructions Youtube

Illinois Used Car Taxes And Fees

Nj Car Sales Tax Everything You Need To Know

What S The Car Sales Tax In Each State Find The Best Car Price